Bitcoin God Candle?

Almost a God Candle, Bitcoin just crashed!!

🚨 The MFG Bitcoin Trade Report 🚨

By Gerald Peters | Money Flow Trading Society | FullAuto11

MFG Bitcoin Update | Market Update – October 14, 2025 —

Hey MFG,

After last Friday’s close, I needed a drink or five. What a crazy day! It was one for the history books! The day started off as a typical lazy bull market Friday.

President Trump, doing what he does best, took some jabs at the Chinese. This spooked the market. The market was worried that the President might be ready to stir up the pot on a tariff war. This time, he targeted the Chinese and threatened to impose a 100% tariff, setting the stage for major liquidations as the Chinese are not the ones to be told to sit down or take a knee to the American President.

Bitcoin’s been through the grinder this week.

After running hot for weeks, the bitcoin marker got hit with one of the largest liquidations in crypto history — nearly $19 billion in leveraged positions wiped out in less than 48 hours. What we’re seeing isn’t panic — it’s pressure. Leverage, tariffs, and macro noise all colliding at once.

When you zoom out, this is exactly how the Money Flow moves: price expands (S2), contracts (S3) and resets (S4) before the next leg up. Don’t mistake volatility for weakness — it’s simply price discovery in real time.

👀 BITCOIN REPORT — The Money Flow View 👀

When you give first, followers come naturally.

Bitcoin experienced a significant decline last Friday evening, October 12-25, despite its recent surge in momentum. This pullback occurred after Bitcoin had just reached an all-time high. The surge in global macro tensions led to a cascading effect of liquidations, causing Bitcoin to plummet.

“The bitcoin market got hit with one of the largest liquidations in crypto history — nearly $19 billion in leveraged positions wiped out in less than 48 hours.”

The cryptocurrency sector is highly leveraged, which is why the drops can be so severe. Forced liquidation is the worst day for traders, and I can attest to this firsthand.

As a result, the flagship cryptocurrency plummeted by 8.4%, reaching $104,782, which undermined crucial support zones.

My charts showed price touching as low as $105,800 level.

The selloff was largely precipitated by a dramatic escalation in U.S.–China trade rhetoric: President Trump announced tariff hikes on Chinese exports and broader export controls, roiling markets.

Over $10 billion in crypto positions were liquidated in 24 hours—one of the steepest waves in recent months—underscoring how fragile sentiment has become amid stretched valuations.

Still, underlying structural flows remain bullish: global crypto-focused ETFs drew a record $5.95 billion in inflows the week ending October 4, with Bitcoin alone capturing $3.55 billion.

About 2/3rd of new capital went directly into Bitcoin. Bitcoin dominance continues.

As Bitcoin consolidates near key technical levels, the risk-reward environment sharpens—whether today’s dip becomes an opportunity or turns into a deeper correction may hinge on macro headlines in the coming sessions.

“This coming week will give us better insight; we’re staying bullish until It’s obviously wrong.” MFG Trade Desk

Sell off Session 👇 10-12-25

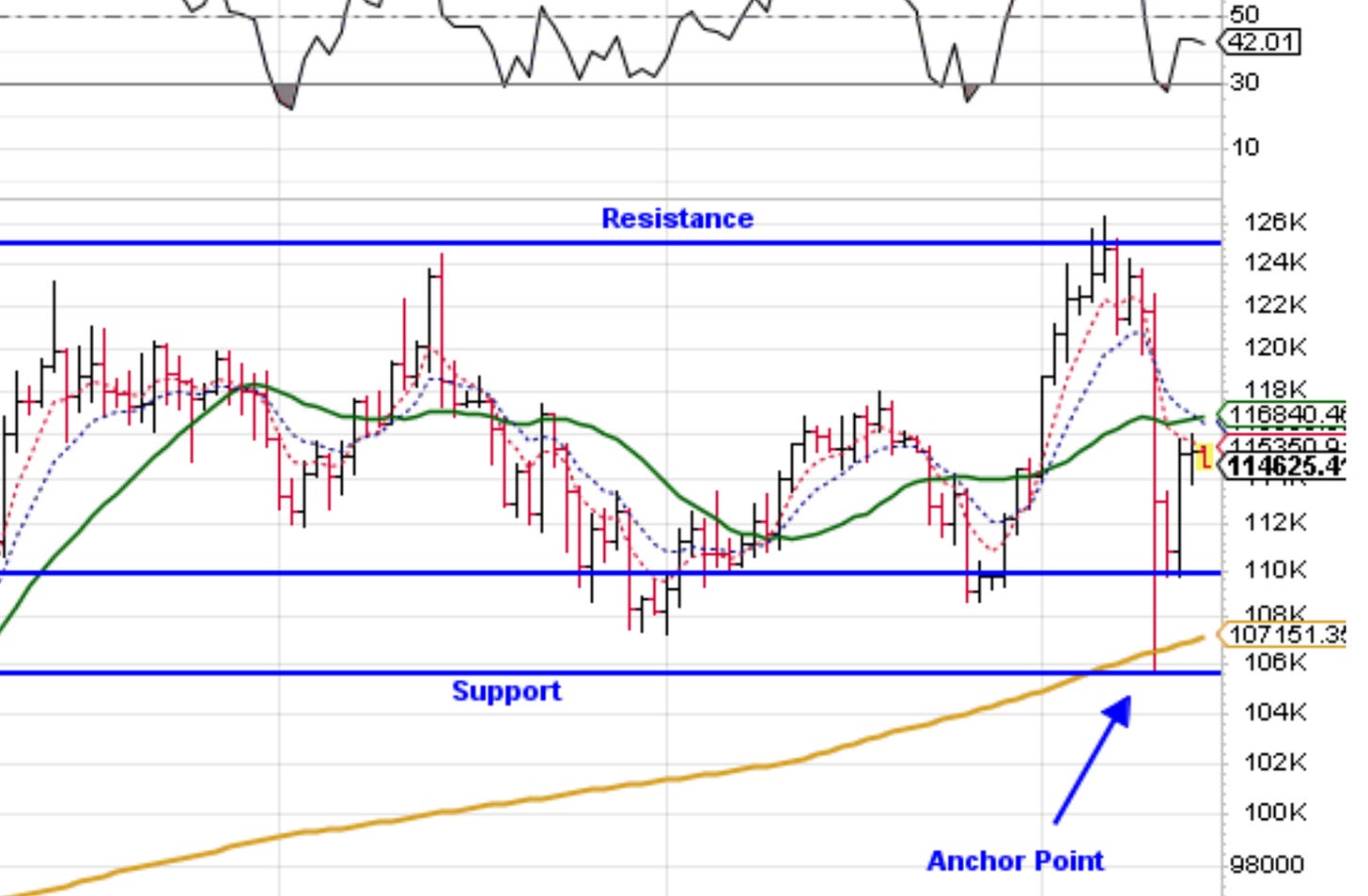

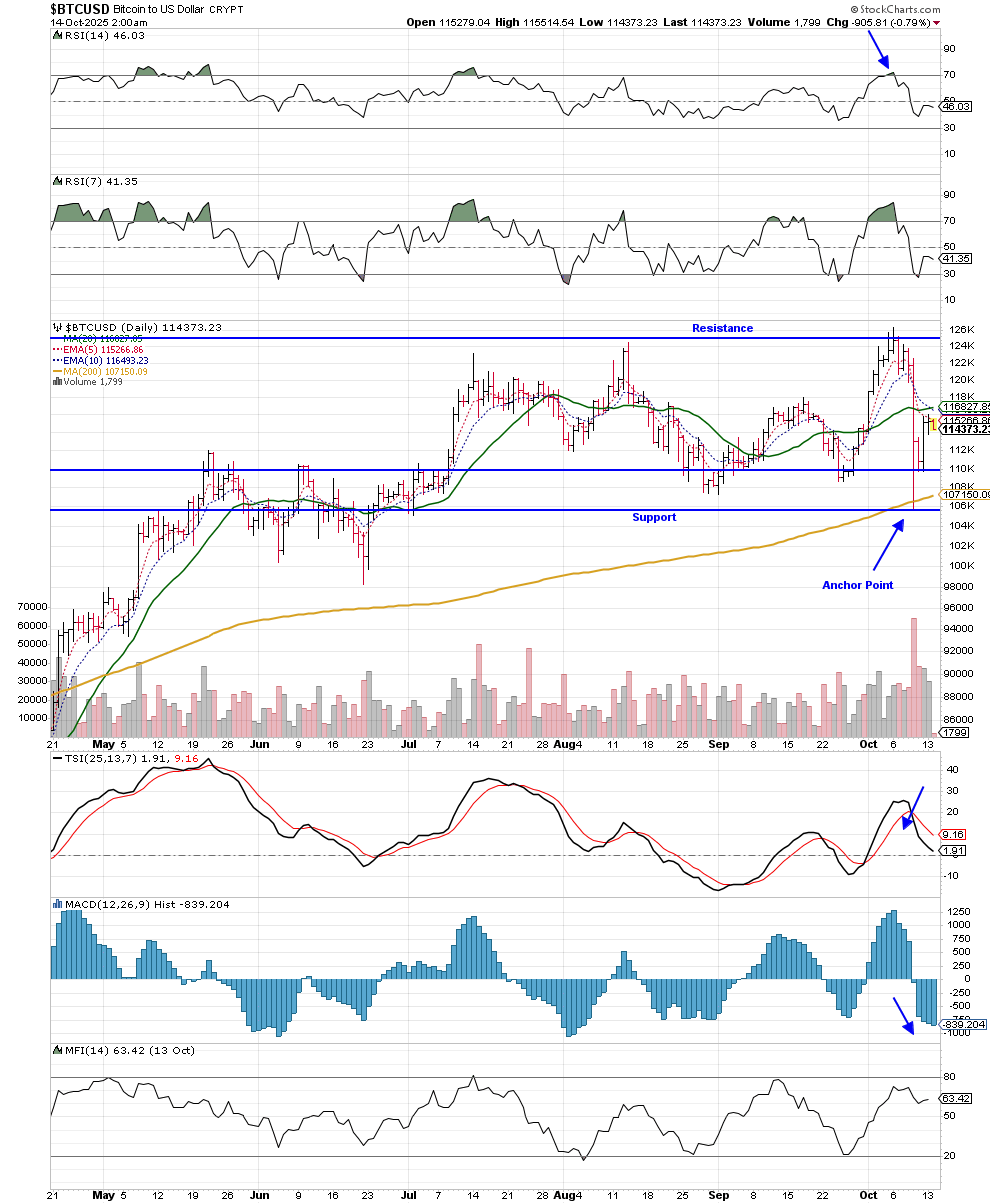

Today’s Chart: (10-13-25) has improved somewhat. But the momentum to the upside has been broken for now.

Looking at the 30-minute chart, the trend remains mostly bearish, with a clear downward movement from left to right.

Take note of the blue and yellow lines as they both slope from the upper left to the lower right. There appears to be potential support around the $113,700 range, which I hope will hold.

Videos Definitely worth watching: Tom Lee 👇

The MFG chart CHECK-IN with G -👇 aka @fullauto11

Gerald Peters - @fullauto11 Text 1-936-661-7786

Exciting times! Thanks for the Bitcoin updates